south dakota sales tax on vehicles

If you are interested in the sales tax on vehicle sales. South Dakota Codified Laws for Sales and Use Tax.

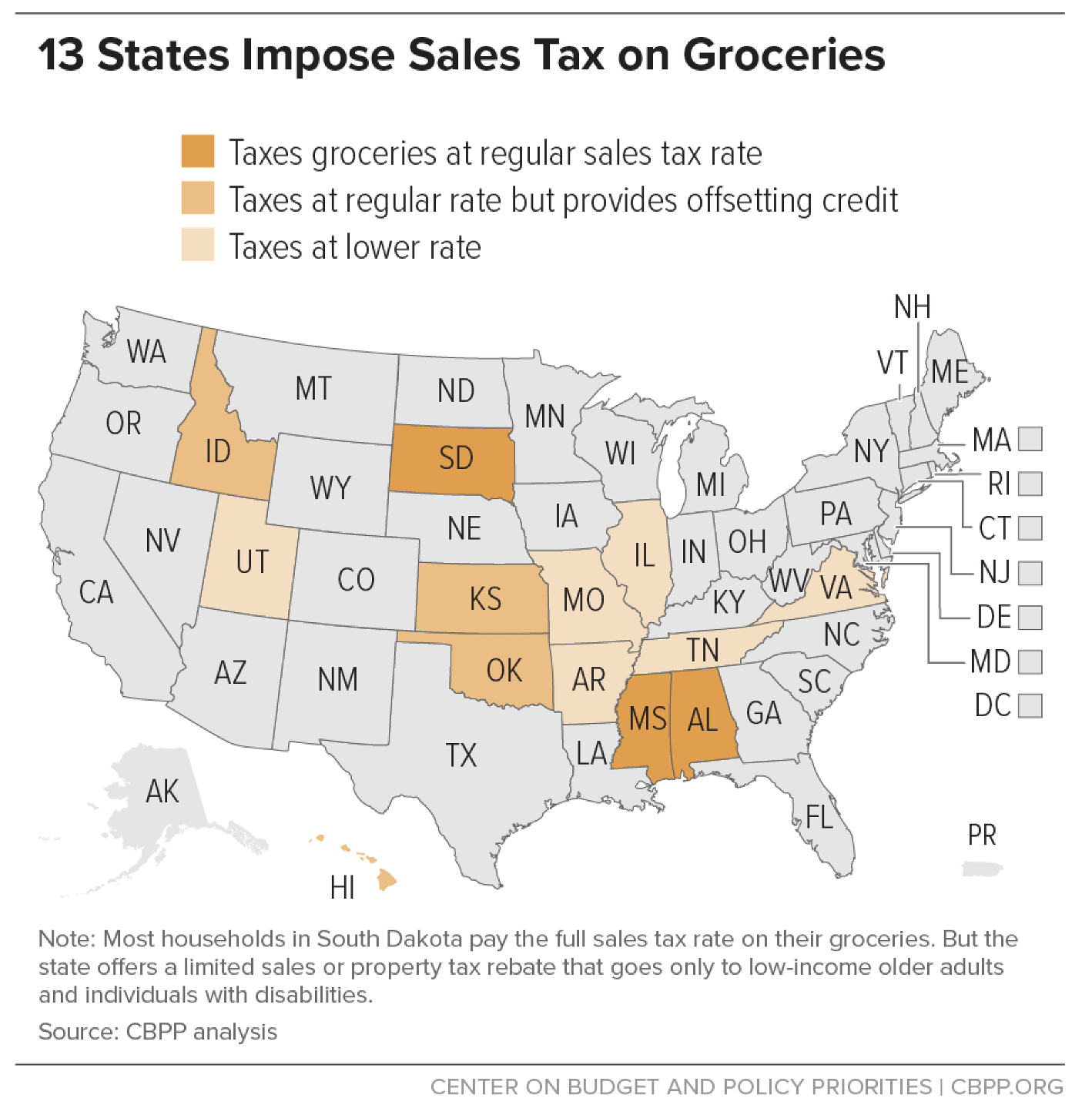

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

The cost of a vehicle inspectionemissions test.

. Counties and cities can charge an additional local sales tax of up to 2 for a maximum. Average Local State Sales Tax. The vehicle is exempt from motor vehicle excise tax under.

In the state of South Dakota sales tax is legally required to be collected from all tangible physical products being sold to a consumer. In addition to taxes car purchases in South Dakota may be subject to other fees like registration. SDCL 10-52A Municipal Gross.

Municipalities may impose a general municipal sales tax rate of up to 2. South Dakota collects a 4 state sales tax rate on the purchase of all vehicles. South Dakota collects a 4 state sales tax rate on the purchase of all vehicles.

All car sales in South Dakota are subject to the 4 statewide sales tax. The laws applicable in South Dakota allow a business person to include sales tax on the price of the products or services they offer. Maximum Possible Sales Tax.

South Dakota has a motor vehicle excise tax fee of 4 percent of the purchase price. The cost of your car insurance policy. Report the sale of a vehicle.

Different areas have varying additional sales taxes as well. To calculate the sales tax on a car in South Dakota use this easy formula. They may also impose a 1 municipal gross.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Starting January 1 2023 the State of South Dakota will be issuing a new plate design for non-commercial and emblem plates with. The sales tax applies to the gross receipts of all retail sales including the sale lease or rental of tangible personal property or any product transferred electronically and the sale of services.

South Dakota State Sales Tax. SDCL 32-1 State Administration of Motor. In addition to taxes car.

Get Started Laws Regulations. Print a sellers permit. South Dakota has a 45 statewide sales tax rate.

That is the amount you will need to pay in sales tax on your. And 2reside on indian country as defined by 18 usc. Costs include the registration fees mailing fees mailing fee is 1 for each registration renewed and a processing fee.

In South Dakota the sales and use tax rate is 45. The South Dakota Department of Revenue administers these taxes. The first buyer is exempt if the dealer has.

The South Dakota DMV registration fees youll owe. South Dakota charges a 4 excise sales tax rate on the purchase of all vehicles. For vehicles that are being rented or leased see see taxation of leases and rentals.

In addition for a car purchased in South Dakota there are other applicable fees including registration title and. South Dakota laws and regulations regarding vehicle ownership. - All sales of vehicles by auction are subject to either sales or use tax or motor vehicle excise tax unless exempt under.

A South Dakota man was transported to the hospital as. 150 for echeck or 225 for debit or credit card. SDCL 10-45 Retail Sales and Service Tax.

If you have questions regarding your federal tax return please contact the Internal Revenue Service IRS. Any titling transfer fees. The highest sales tax is in Roslyn with a.

First multiply the price of the car by 4. Additionally South Dakota has a motor vehicle gross receipts tax of 45 percent that. The South Dakota state sales tax rate is 4 and the average SD sales tax after local surtaxes is 583.

11-14-2022 1 minute read. SDCL 10-52 Uniform Municipal Non-Ad Valorem Tax Law. South Dakota does not impose a corporate income tax.

South dakota collects a 4 state sales tax rate on the purchase of all vehicles. 6 hours agoA SOUTH DAKOTA man was seriously injured in a single-vehicle accident north of Stanton on Saturday. State sales tax and any local.

Maximum Local Sales Tax.

Democrats Persuade Noem To Promise Food Tax Repeal Smith Winning Dakota Free Press

Price Jump For Used Cars Results In Boost In Iowa Sales Tax Collected Iowa Thecentersquare Com

How To File And Pay Sales Tax In South Dakota Taxvalet

License Requirements For Sales Use Amp Contractors Excise Tax

North Dakota Sales Tax Handbook 2022

South Dakota Vehicle Registration Vehicle Registration Services Dakotapost

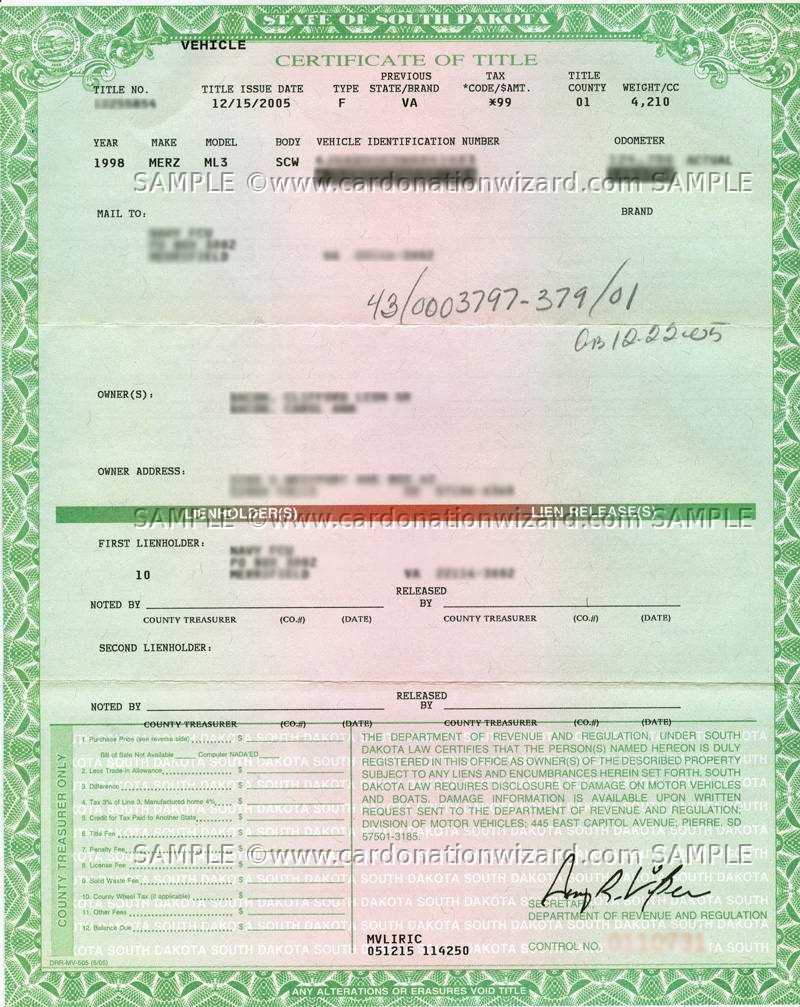

South Dakota Title Transfer Donate A Car In Sd On Car Donation Wizard

Post Wayfair Options For States South Dakota V Wayfair Tax Foundation

Sales Taxes In The United States Wikipedia

South Dakota Income Tax File Old Tax Returns

South Dakota And Sd Income State Tax Return Information

Sales Tax Reports A Good Sign For South Dakota Communities

Printable South Dakota Sales Tax Exemption Certificates

Are There Any States With No Property Tax In 2022 Free Investor Guide

_(1).jpg)

Deduct The Sales Tax Paid On A New Car Turbotax Tax Tips Videos

Nj Car Sales Tax Everything You Need To Know

Sales Use Tax South Dakota Department Of Revenue

Gov Kristi Noem Touts Campaign Proposal To Eliminate Sales Tax On Groceries Mitchell Republic News Weather Sports From Mitchell South Dakota

How To Register Your Vehicle In South Dakota From Anywhere In The Usa Without Being A Resident Dirt Legal